NHS Pension Scheme: Consultation and proposed changes from April 2024

09/11/23The government has recently launched a consultation on various proposals including amendment to the employer and employee member contributions to the NHS Pension Scheme.

The proposals include:

- amendment to employer and employee contribution rates to reflect the results of the 2020 scheme valuation

- permanent removal of abatement for special class status (SCS’) members, in line with the Agenda for Change pay deal for 2023 to 2024

- various other amendments.

Changes to member contributions

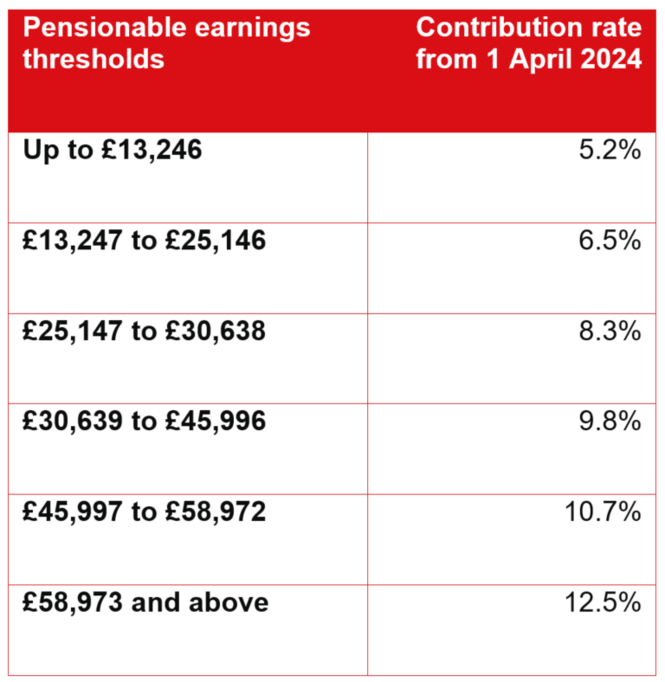

Following the uplift in member contributions thresholds in October 2022, there are proposals to make further changes to member contribution thresholds from 1 April 2024.

The proposed changes are:

New employer contribution rate

A valuation of the NHS Pension Scheme was completed on 19 October 2023 (the ‘2020 valuation’). This valuation is an actuarial assessment of past and future pension benefits building up within the scheme and is carried out on a four-year cycle. The results are used to determine the employer contribution rate required to meet current and projected scheme liabilities.

New employer contribution rate from 1 April 2024

Employers currently pay 20.6% of a member’s pensionable pay towards the cost of pension rights they build up (plus an administration charge of 0.08%). To alleviate cost pressures on employers since 1 April 2019, generally 6.3% of the employer contribution owed has been paid centrally by either NHS England or DHSC (Department of Health and Social Care, so employers are currently paying 14.38%.

Results from the 2020 actuarial valuation show an increase in benefit costs, requiring a 3.1 percentage point rise in the employer contribution rate to 23.7%.

This will be financed by the Exchequer/central government.

However, the percentage of pensionable pay for which employers are directly invoiced by NHS Business Services Authority (NHSBSA) will not change on 1 April 2024 (with the exception of medical schools). NHS England or DHSC will pay NHSBSA centrally for the 3.1% increase (2.64% for medical schools).

Abatement for pensions for special class members who return to work

Subject to Parliamentary approval, DHSC intends to amend the 1995 NHS Pension Scheme rules to permanently abolish abatement for special class members.

Carers’ leave

DHSC proposes to amend the regulations to insert a provision for members who take unpaid carer’s leave. The changes, if approved, will provide further flexibility for working unpaid carers, by allowing them to be absent from work to fulfil their caring responsibilities.

Abolition of the lifetime allowance

Subject to Parliamentary approval, DHSC proposes making changes to the 1995, 2008 & 2015 regulations as well as, the transition regulations to ensure compliance with the Finance Act which has abolished the life time allowance.

Partial Retirement

Maximum service

DHSC proposes amendments to the scheme regulations from the 1 April 2024 to make the existing partial retirement option, available to members of the 1995 Section who have breached the maximum service limits.

Salary sacrifice

DHSC proposes to clarify in the regulations that, where a member enters into a salary sacrifice arrangement, this in itself, cannot be used to effect a 10% reduction in pensionable pay for the purposes of taking partial retirement, effective from 1 April 2024.

The consultation closes on 7 January 2024.

How Capsticks can help

Capsticks has significant experience of supporting healthcare sector employers on a wide variety of pension issues, so you can operate effectively within the NHS Pension Scheme and avoid risks for your organisation and employees.

If you have any questions around what is discussed in this insight, please contact Neil Bhan or Rebecca Foster.